Let’s Start with the Basics: What Is a Home Equity Loan?

Okay, so you’ve heard about a home equity loan—probably tossed around at family dinners, or maybe it popped up during a midnight scroll through finance YouTube. But what is a home equity loan, exactly?

In the simplest terms, a home equity loan is a way to borrow money using the value of your home. Not the entire market value—just the portion you own. So if your house is worth $300,000 and you’ve paid off $150,000 of your mortgage, then you potentially have $150,000 in equity to work with.

Think of it like tapping into a savings account you didn’t even realize you were building. The kicker? You’re still living in the house while using its value to cover other costs—renovations, education, a wedding, or (hey, no judgment) a dream motorcycle trip across Europe.

And it’s not the same as refinancing. We’ll get to those differences in a minute.

Step 1: What Even Is Home Equity? (And Why Should You Care?)

Here’s the thing—home equity is one of those terms that sounds boring until you realize it’s low-key powerful.

Home equity = Your home’s current market value – Your remaining mortgage balance.

It builds over time as you make mortgage payments and as your home (hopefully) appreciates. The more equity you have, the bigger the loan you might be eligible for.

Quick comparison to help you out:

- Home Value is what your house could sell for on the open market.

- Home equity is what you’d pocket if you sold it today and paid off the bank.

Why does this matter? Because lenders look at your equity as collateral. That’s what makes a home equity loan a “secured loan.” If things go sideways, they can recover their money by claiming your home. Yeah—high stakes. But also lower interest rates, since you’re less risky in their eyes.

Step 2: The Pre-Game Checklist (Don’t Skip This Part)

So, before you even think about filling out an application, let’s talk eligibility. Because trust me, you don’t want to waste time submitting paperwork just to get ghosted by a lender.

Here’s what most lenders are eyeballing:

- Credit Score – 620+ is usually the baseline. But the higher, the better.

- Debt-to-Income Ratio (DTI) – Ideally under 43%. They want to know you’re not drowning in payments.

- Loan-to-Value Ratio (LTV) – Most lenders let you borrow up to 80–85% of your home equity. Some go higher, but they might charge more interest.

- Stable Income – Pay stubs, tax returns, bank statements—expect to show proof you can repay.

- Property Type – Primary residences get the best rates. Investment properties? Not so much.

Pro tip: Check your credit report before applying. Services like Credit Karma or Experian can show you where you stand. Fix any errors or weird accounts upfront.

And yeah—get all your documents in one place. It’s boring. It’s time-consuming. But it makes you look like someone who’s got their life together, and lenders love that.

Step 3: Applying Like a Pro – Online or Face-to-Face?

Let’s be real: we live in an age where you can order sushi, groceries, and a gaming console from your couch. So yes, you can apply for a home equity loan online.

But here’s the deal—just because it’s convenient doesn’t mean it’s better. Some folks still prefer walking into a branch and getting face time with a loan officer.

Online Application Pros:

- Fast, digital, no appointments

- Often pre-qualify without a hard credit pull

- Easy to compare offers side-by-side

In-Person Application Pros:

- Personalized advice

- Easier to explain special circumstances (e.g., freelance income)

- Local banks or credit unions may offer better terms

Where’s the best place to get a home equity loan? Honestly, it depends. Big names like Wells Fargo, U.S. Bank, and Bank of America are solid, but don’t ignore local credit unions—they can surprise you with flexible options.

Also, some fintech lenders now offer competitive home equity products. Just check for FDIC insurance and legit customer reviews.

Step 4: Appraisals and Paperwork – Yeah, This Part’s Kinda Tedious

Once your application’s in, the lender starts sniffing around (figuratively, we hope). That’s when the home appraisal happens. It’s a crucial part of the timeline and one that people often underestimate.

Why? Because the amount you can borrow depends on your home’s current value, not what you paid for it five years ago.

An appraiser (a third-party pro, not your lender’s cousin) will come by, look around, measure stuff, and compare your property to similar homes in your neighborhood. They’re checking:

- Property condition

- Recent renovations

- Square footage

- Market comps (like Zillow, but way more legit)

This usually takes 1–2 weeks, depending on scheduling.

Meanwhile, you’ll be uploading docs like:

- Recent pay stubs and W-2s

- Tax returns

- Mortgage statement

- Homeowners insurance proof

- A photo ID

If you’re self-employed, buckle up—they’ll want extra paperwork. Bank statements, 1099s, maybe even client contracts.

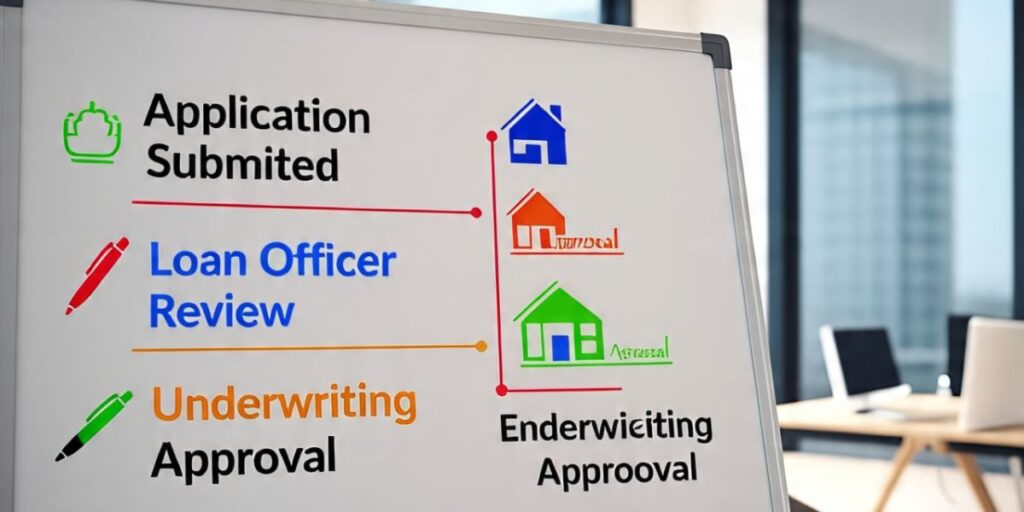

Step 5: The Waiting Game – Approval & Funding

Alright, you’ve jumped through the hoops. Now what?

The lender is reviewing everything: your credit, your income, and your appraisal. And this can take 2 to 6 weeks, depending on the lender and how responsive you are with document requests.

Once you’re approved, you’ll get a Closing Disclosure—kind of like a final receipt that outlines your loan terms. Review it carefully. Don’t just skim it while watching Netflix.

After that, you’ll schedule a closing appointment. You’ll sign a mountain of paperwork (either at a notary’s office or online via e-sign), and then…

🕒 Three-day waiting period (required by federal law for primary residences)

On day four, boom—loan funded. The money shows up in your account, ready to use.

Step 6: Repayment Time – Don’t Zone Out Here

This is where it gets real. You borrowed money, and now it’s time to pay it back.

Typical Home Equity Loan Repayment Terms:

- Fixed interest rates – You know exactly what your payment is every month

- 5–30 year terms – Most common is 10 to 15 years

- Monthly payments – Just like a mortgage

Your repayment schedule is locked in at closing, so no surprises down the road. Most people appreciate that predictability, especially if you’re budgeting like a grown-up (or at least trying to).

Rates vary, but as of mid-2025, they’re hovering between 7 and 9%, depending on your credit and the lender. That’s still cheaper than a personal loan or credit card but more than your original mortgage.

Oh, and if you’re late on payments? Not good. You could lose your house. So yeah, don’t treat it like monopoly money.

Final Thoughts: From Application to Cash in Hand (And a Few Bonus Tips)

So let’s recap the journey, shall we?

- Understand your equity — Know what you own

- Get your paperwork in order — Lenders love that

- Choose the right lender — Compare terms, not just rates

- Prepare for the appraisal — Clean the house, do small fixes

- Be responsive — Faster replies = quicker approvals

- Read the fine print — No one likes nasty surprises

- Stick to your budget — Use the loan smartly, not impulsively

Bonus Tips for the Young Dudes Out There:

- Planning to start a business? A home equity loan can be a cheaper way to finance than a risky unsecured loan.

- Want to renovate your space? Invest in upgrades that increase home value—like kitchens and bathrooms, not lava lamps and poker tables.

- Already house-rich but cash-poor? This could be your lifeline—but don’t get reckless.

And remember, you’re borrowing against your home. That’s a big move. It’s not like maxing out a credit card to buy a PS5. There’s more at stake.

But if you’re strategic—and just a little disciplined—it could be the best financial move you make this decade.

P.S. Got questions about your eligibility or want help comparing lenders? There are online calculators (check out NerdWallet or Bankrate) that make the math part way easier.

And if you’re still unsure whether a home equity loan makes sense for your situation, talk to a loan advisor. Seriously. It’s free, and they’ve heard every question under the sun.

You got this.